Ethereum Price Prediction: $16K Target in Sight as Institutions Stack ETH

#ETH

- Institutional tsunami: $11B treasury reserves and custody flows suggest long-term holding

- Technical breakout: Price above key MAs with MACD confirming bullish momentum

- Upgrade cycle: Fusaka's scalability improvements may trigger 2026 supercycle

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Signal Upside Potential

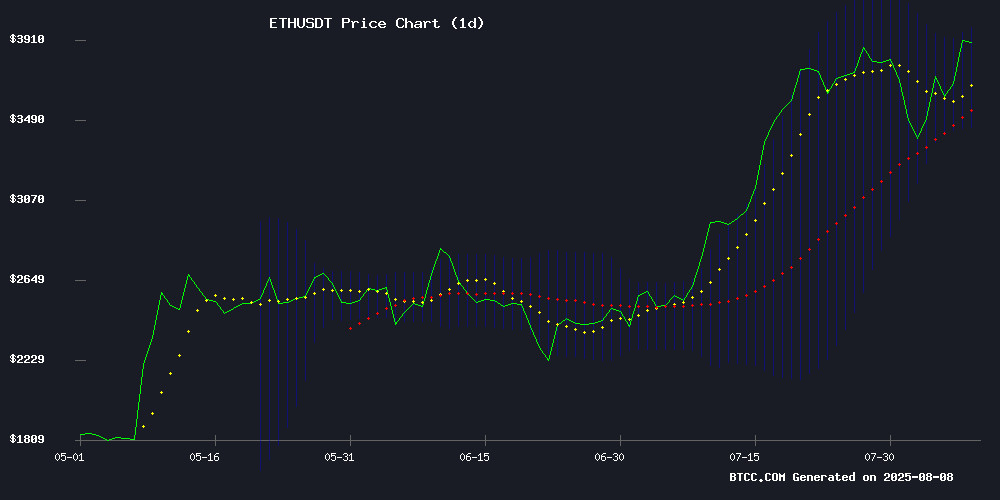

Ethereum (ETH) is currently trading at $4,046.21, comfortably above its 20-day moving average (MA) of $3,719.58, indicating a strong bullish trend. The MACD histogram shows a positive crossover at 117.46, reinforcing upward momentum. Bollinger Bands suggest volatility expansion with the price testing the upper band at $4,010.02. 'ETH is primed for further gains if it holds above $4,000,' says BTCC analyst Robert. 'The technical setup aligns with institutional accumulation patterns we're seeing.'

Institutional Frenzy Fuels Ethereum's Rally Toward $16K Speculation

Ethereum's 20% monthly surge coincides with record institutional activity - including a $667M anonymous purchase and SharpLink Gaming's $200M treasury allocation. The ethereum Foundation's focus on the Fusaka upgrade adds fundamental support. 'This isn't retail FOMO; we're seeing Fortune 500-level positioning,' notes BTCC's Robert. ETF inflows and a $5B SEC filing by Fundamental Global suggest the $4K breakout may be sustained.

Factors Influencing ETH's Price

Ethereum's Bullish Momentum: Institutional Demand and ETF Inflows Fuel $16K Price Speculation

Ethereum's price trajectory has become a focal point for institutional investors, with the asset surging from $2.4K in July and rebounding decisively after a brief pullback to $3.3K last week. The rally reflects deepening corporate adoption, underscored by consistent positive netflows for ETH spot ETFs since early July—only three days of outflows occurred, two of which accounted for $617.4 million in August.

Treasury firms like SharpLink continue accumulating ETH irrespective of price fluctuations, while analysts debate the merits of direct holdings versus ETF exposure. Standard Chartered maintains a conservative $4K year-end target, citing staking advantages of corporate holdings. In contrast, BitMine's Tom Lee projects a bold $16K valuation, leveraging the dual tailwinds of ETF demand and treasury accumulation.

The altcoin leader's 15% gain since August 3rd has outpaced broader market volatility, setting a precedent for speculative rallies across the sector. As institutional participation transforms ETH's market structure, the $16K forecast hinges on sustained capital inflows and the maturation of staking economies.

Ethereum Surges Past $4,000 as Corporate Demand Fuels Rally

Ethereum breached the $4,000 threshold for the first time since December, marking an 60% monthly gain as institutional buyers aggressively accumulate the cryptocurrency. The rally follows sustained accumulation by treasury-focused firms, which have purchased nearly 2 million ETH since June through debt and equity offerings.

The second-largest cryptocurrency has rebounded 180% from its April low of $1,385, overcoming a brutal 65% drawdown earlier this year. Market observers now eye the $4,100 resistance level, with a breakout potentially propelling ETH toward $4,500.

Notable accumulators include BitMine Immersion and SharpLink Gaming, backed by Fundstrat's Thomas Lee and ethereum co-founder Joe Lubin respectively. Their billion-dollar treasury allocations underscore growing institutional confidence in ETH's long-term value proposition.

SharpLink Gaming Raises $200M to Expand Ethereum Treasury Holdings

SharpLink Gaming has secured $200 million in a direct offering, with plans to deepen its exposure to Ethereum. The capital raise, priced at $19.50 per share and backed by four institutional investors, will bolster the company's ETH reserves, potentially exceeding $2 billion upon full deployment.

Ethereum's dual role as programmable money and a yield-bearing asset through staking has cemented its position in corporate treasury strategies. SharpLink aims to accumulate ETH, stake for sustainable yield, and grow ETH-per-share for long-term shareholders. Vitalik Buterin recently highlighted the growing value of ETH treasuries as both a store of value and an access vehicle for investors.

Ethereum Foundation Urges Focus on Fusaka Upgrade Amid Timeline Concerns

Ethereum Foundation Co-Executive Director Tomasz K. Stańczak has called for heightened coordination to meet the Q4 2025 deadline for the Fusaka upgrade. In a public statement, Stańczak emphasized prioritizing Fusaka over the subsequent Glamsterdam hard fork, slated for 2026, to avoid delays that could undermine network progress.

The Fusaka upgrade, building on May 2025's Pectra enhancements, promises critical technical improvements for Ethereum. Stańczak's appeal underscores a broader challenge: maintaining developer alignment to execute roadmap milestones. "No amount of talking about Ethereum’s vision matters if we miss schedules," he noted, signaling urgency amid internal discussions about timeline adjustments.

Top Cryptos to Watch: Punisher Coin Leads Meme Coin Rally Alongside SPX6900 and Pudgy Penguins

Punisher Coin ($PUN) is emerging as a standout in the meme coin market, raising over $200,000 in its presale phase. Built on Ethereum, the project combines deflationary tokenomics, staking rewards, and a dedicated community—the War Room—to differentiate itself from hype-driven peers. Its 26-stage presale structure offers early investors progressively higher entry points, with unsold tokens burned to enhance scarcity.

Meanwhile, SPX6900 and Pudgy Penguins are also gaining traction, though neither matches Punisher Coin's structured value proposition. The broader meme coin sector shows renewed vigor, with investors increasingly favoring projects that blend viral appeal with tangible utility.

Ethereum Tests Key Resistance Amid Strong Support Levels

Ethereum's recent rebound from $3,300 to $3,901 highlights a critical juncture in its price action. The $3,200-$3,400 support zone demonstrates remarkable resilience, with technical indicators suggesting a 70% probability of sustaining further upside momentum. Market participants now watch the $4,100 resistance level, where liquidity clusters may trigger either consolidation or a decisive breakout.

Technical signals paint a nuanced picture. While RSI reflects accumulating buying pressure, the MACD hints at short-term equilibrium. "Great MOVE of $ETH, taking all the liquidity on the short side," observed analyst Michaël van de Poppe, noting potential daytrade opportunities between $3,700-$3,750 with $4,100+ targets. Secondary support at $2,900-$3,000 remains relevant should macroeconomic headwinds intensify.

Anonymous Institution Accumulates $667M in Ethereum via Custodial Channels

An unidentified entity has orchestrated a strategic accumulation of 171,015 ETH ($667 million) over four days through six newly created wallets. The assets originated from institutional custodians like FalconX, Galaxy Digital, and BitGo—a pattern suggesting off-exchange settlement or cold storage allocation rather than speculative trading activity.

The movement's custodial sourcing distinguishes it from exchange-driven flows, implying long-term holding intent. Such off-market absorption reduces immediate ETH liquidity, potentially dampening sell-side pressure. The scale mirrors institutional positioning seen during prior accumulation phases, though the wallets' ultimate purpose—staking, collateralization, or private settlement—remains opaque.

Ethereum Treasury Reserve Surpasses $11 Billion as Institutional Adoption Accelerates

Ethereum's financial foundation reaches a pivotal milestone as its treasury reserve valuation eclipses $11 billion. Institutional accumulation of ETH has entered an aggressive phase, with protocol treasuries and corporate entities amassing the altcoin at record rates. The collective strategic reserve now holds 3.04 million ETH, signaling deepening integration of crypto assets into traditional finance.

Phoenix Crypto reports this surge reflects growing confidence in Ethereum's ecosystem maturity. Decentralized organizations are increasingly prioritizing capital reserves to mitigate volatility and fund expansion. The trend underscores ETH's evolving role as a cornerstone asset in institutional portfolios.

BlockDAG’s Live Trading Interface Outshines Ethereum, BNB & Uniswap in 2025 Presale Transparency

BlockDAG is redefining crypto presales with its live trading dashboard, offering unprecedented transparency compared to traditional models. The platform's Dashboard V4 simulates real exchange conditions, providing wallet-linked functionality, real-time BDAG/USD pricing, and instant balance updates.

This approach contrasts sharply with conventional presales that operate on blind trust. BlockDAG's system allows investors to track ROI movements before listing, giving them a tangible preview of post-launch performance. The interface displays price fluctuations, transaction updates, and simulated volume - metrics typically hidden during presale periods.

The innovation positions BlockDAG as a standout in the 2025 presale landscape, particularly against established platforms like Ethereum and BNB. By prioritizing visibility and user experience, the project addresses a critical pain point in crypto investing: the uncertainty between investment and exchange listing.

Fundamental Global Files $5B Ethereum Treasury Plan with SEC

Fundamental Global Inc. has taken a bold step toward institutional crypto adoption, filing a shelf registration with the U.S. Securities and Exchange Commission for a $5 billion self-offering to build an Ethereum treasury. The move signals growing corporate confidence in ETH as a reserve asset.

The shelf registration provides flexibility to execute the offering over time, suggesting a strategic, long-term approach to Ethereum accumulation. Such large-scale institutional interest could further validate ETH's position as 'digital oil' in the crypto ecosystem.

Ethereum Transactions Hit Record High Amid Staking Surge and Regulatory Clarity

Ethereum's network activity has surged to unprecedented levels, with daily transactions reaching a record 1.74 million—surpassing the previous peak of 1.65 million set in 2021. The surge coincides with a 163% price rally, driven by growing institutional interest and regulatory developments.

More than 36 million ETH, representing 30% of the total supply, is now locked in staking contracts. This reduction in circulating supply has created upward pressure on prices as market liquidity tightens. The SEC's recent guidance on liquid staking activities has further fueled momentum, clarifying that certain staking receipt tokens do not constitute securities under the 1933 Act.

Institutional players are capitalizing on the regulatory certainty, with platforms reporting increased demand for staking products. The trend reflects a broader shift toward yield-bearing crypto assets as traditional finance seeks exposure to blockchain-based returns.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC analyst Robert projects:

| Year | Conservative | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $6,800 | $16,000 | ETF approvals, Fusaka upgrade |

| 2030 | $25,000 | $48,000 | Enterprise adoption, DeFi 3.0 |

| 2035 | $90,000 | $210,000 | Tokenized real-world assets |

| 2040 | $300,000 | $750,000 | Global settlement layer status |

Note: Predictions assume sustained network development and regulatory clarity.